At CaixaBank, we offer a wide variety of cards, so you can choose the one that best suits your financial needs.

At CaixaBank, we offer a wide variety of cards, so you can choose the one that best suits your financial needs.

At CaixaBank we offer a wide variety of cards so you can choose the one that best suits your financial needs.

With a credit card, you pay for your purchases without using your account balance. Your card has an assigned credit limit (a maximum monthly amount you can spend) and at the end of the agreed settlement period (usually each month) you have to pay the amount you have used for your purchases. You can customise the repayment terms for your credit card and pay off what you have spent weekly, monthly, or another specific day you determine ( every time you have €500 available, for example). If you pay off all your credit by the agreed payment date you do not pay interest.

On the other hand, you can change the payment method of your card to deferred payment (paying only an amount of the (used) credit every month) -+ info in Deferred payment (Revolving) - or payment in instalments (dividing the payment of a specific purchase over several months). In both cases you will have to pay interest.

You can see the usual prices for frequent banking services (Annex 1) at https://www.caixabank.es/particular/general/tarifascomisiones_es.html

In the following video we explain how and when to use a credit card with the end of the month payment modality or when changing it to deferred payment:

With your debit card you pay for your purchases using your account balance. You thus need to link an account to the card (the account does not necessarily have to be a CaixaBank account). If you plan to use a debit card for your purchases, it is important to know that if you do not have money in the account, you will not be able to make purchases, as purchases are charged instantly against the account balance. With the debit card you can make purchases (in physical shops and online) and withdraw cash from ATMs.

A prepaid card (also called a wallet card) is similar to a debit card because when you pay for purchases you use your own money and not the money we lend you (as when using a credit card). Unlike the debit card, however, the prepaid card is not associated with any bank account. It is simply a card onto which you reload money (whatever amount you want) and that you can use until the balance loaded has been used up. You can reload the balance again as many times as you like, so you can always control your spending.

If you are not yet sure what card you need, in these two videos we explain each type of card and its particular characteristics to help you decide:

End-of-month payments

Payment in 2 days

Deferred payment (revolving)

A credit card with an end-of-month payment modality involves you paying off the credit you used for your purchases at the end of the agreed settlement period (e.g. at the end of the month, if you choose the monthly settlement period). You will not have to pay interest for this.

This will be the default payment method for cards with the end-of-month payment modality (such as the Visa Classic).

Let us give you an example: John takes a weekend getaway with his friends on Friday, 14 April. He decides to use his credit card to rent a car and invites his friends to dinner. The credit card is used as a guarantee for the car rental and is also used to pay for dinner. This dinner was purchased on credit, meaning he doesn't need to spend the balance in his account on the actual day of the dinner with his friends. John will start to pay back the money spent on the dinner without interest from 1 May. We will charge it to the account associated with the card.

The card also allows other payment methods that you must expressly request, such as deferred payment of all the credit you have on a monthly basis, or payment in instalments of a certain transaction or purchase. These two payment methods do require interest payments, which are specified both in the pre-contractual information (INE) and in the contract.

Deferred payment consists of putting off (or deferring) the repayments for the credit you spend through the payment of a monthly instalment, instead of paying the total amount at the end of the agreed settlement period. This way you decide what monthly instalment you want to make to repay the credit drawn down. Even if you spend more credit each month than the chosen instalment, you will only pay the chosen instalment, provided that it respects the minimum instalment limit established at any given time by CaixaBank Payments & Consumer so that the repayment of your debt is not dragged out excessively. When choosing the level of the monthly instalment you want to pay, bear in mind that the higher the monthly instalment you pay, the lower the total cost of the credit to be repaid, because you will repay the loaned credit sooner. All credit cards allow you to activate this payment method if you need it. Only one comes with this payment method activated by default without the possibility of changing it, namely the deferred payment card (Visa&Go).

Let us give you another example: John's washing machine breaks down in December, just when he is focused on finishing his Christmas shopping and celebrating with friends and family. He expects an increase in expenses of around €1500, which he will not be able to pay all at once at the end of the month because he would run out of credit at the beginning of the following month. Instead, John chooses to modify the payment method for his credit card to deferred payment, choosing to pay a monthly amount of €150 for the reimbursement of the credit. If he doesn't spend anything more with his credit card, he will end up paying off his debt in a little less than a year, including associated interest. Each instalment includes part of the capital drawn down that John has to repay + part of the associated interest. If he increases the monthly instalment, he will pay off the debt faster. When you pay off the debt faster, you also pay less interest.

To calculate your monthly instalment, you can go to the Bank of Spain's banking customer website where they provide a calculator to figure out how much interest you would pay and when you would end up paying off the debt under one or another level of monthly instalment: https://clientebancario.bde.es/pcb/es/menu-horizontal/podemosayudarte/simuladores/calculo_cuota_tarjeta_revolving.html

Payment in instalments consists of paying for a certain purchase or transaction on credit and instead of paying for it all at the end of the month interest-free, you pay it off over the months you decide to split it over, including associated interest or paying a fixed fee, also reflected in the contract.

Let us give you an example: John wants to buy the latest model smartphone but it costs €1,000, so he doesn't want to pay for it with his end-of-month credit card, as he would have to pay it all off at the end of the month and would be left with nothing in his account. John can choose to split the payment of the purchase over a number of months (either paying associated interest or paying a fee). He selects the term over which he wants to pay back the credit and, in this way, pays the purchase price + the associated interest divided over the months selected for repayment.

The maintenance fee for the Visa Classic is €48/year. Other cards with the end-of-month payment modality may have different maintenance fees, which, if applicable, will be specified during the contractual process.

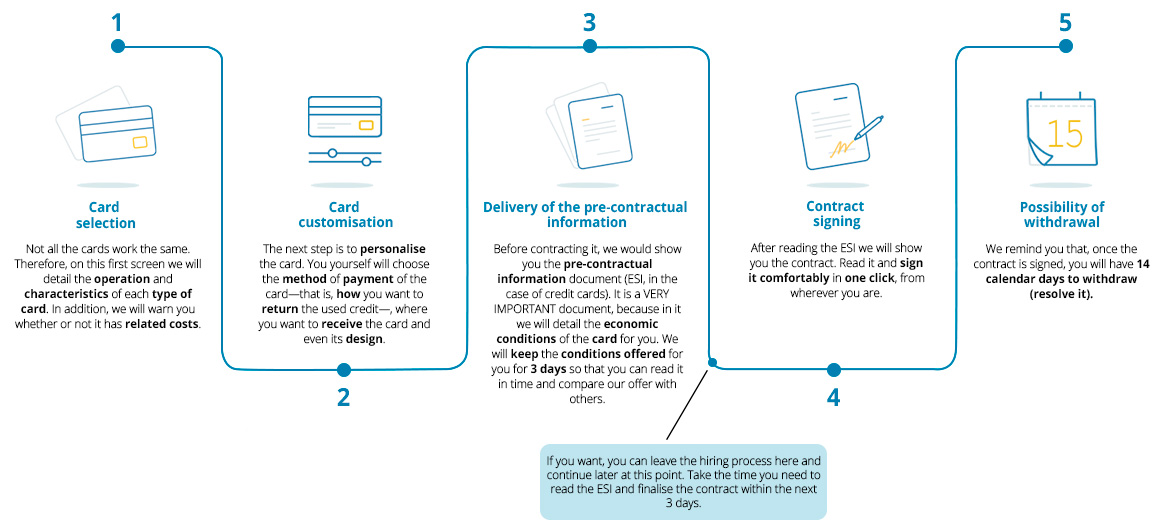

To be as transparent as possible with you and to let you know how our end-of-month card works before you even start the contracting process, we provide you with an example of the pre-contractual information document (INE) and an example of the contract, which we attach below.

PLEASE NOTE: The NIR and APR numbers that you will see in both the example INE and the example contract are specific to the EXAMPLES and therefore may not be those that we will finally apply to your card, as these conditions in the examples are the maximum applicable. We provide the maximum values for these numbers because, as you have not started the contracting process, we have not been able to study your financial situation, so we cannot tell you in advance what financial conditions you will have on your card. For this reason, we prefer to show you the maximum rates.

We also have a credit card with 2-day payment, combining the best of debit and credit. The 2-day payment lets you buy on credit while shortening the settlement period to 48 hours. This way, everything you spend is reflected in your card transactions right away, but it is debited from the associated account in 48 hours. This payment method lets you recover your card's credit limit quickly so you can continue your day-to-day purchases.

This will be the default payment method for cards with 2-day payment (such as Visa &Pay and Visa MyCard).

You also have the option to customise the payment day and instead of paying the credit in 48h, paying it weekly, monthly or as often as you specify (example: once you have spent €200). You will not have to pay interest in any of these cases, since you will return the full amount of the credit drawn down at the end of the agreed settlement period.

This card also lets you use the balance in your account (up to €3,000) once you use up your credit, as long as the associated account where you have the balance is with CaixaBank, and you have sufficient balance to cover both the credit limit you have used up and anything you want to spend over that limit.

Here's an example: Juan uses the card with 2-day payment for everyday purchases. On 10 April, he uses the card to pay €12 for the transport card, on 11 April he spends €6.90 on a salad and on 15 April €25.90 at the supermarket. Juan will see each of these card transactions in the app or CaixaBank Now as soon as they are made, and has to pay back the credit used, with no interest, as follows: €12 on 12 April, €6.90 on 13 April and €25.90 on 17 April.

And an example to understand how to use the balance in the account in addition to using the credit: Juan has a balance of €200 in his CaixaBank account associated with the card, and the credit limit on the card is €100. If he needs to make a purchase for €150, he can do so because he will charge €100 to his card (which he will pay in 48h) and €50 will be paid directly from his account balance at the time of purchase.

The card also allows other payment methods that you must expressly request, such as deferred payment of all the credit you have on a monthly basis, or payment in instalments of a certain transaction or purchase. These two payment methods do require interest payments, which are specified both in the pre-contractual information (INE) and in the contract.

A deferred payment consists of paying back the credit you spend gradually, instead of paying the total amount at the end of the agreed settlement period. This way, you decide what monthly instalment you want to make to pay back the credit used. Even if you use more credit each month than the chosen instalment, you will only pay the chosen instalment, provided that the amount paid back is the minimum specified by CaixaBank Payments & Consumer to ensure your debt is repaid in a timely manner. When choosing the level of the monthly instalment you want to pay, bear in mind that the higher the monthly instalment you pay, the lower the total cost of the credit to be repaid, because you will repay the loaned credit sooner.

Paying in instalments consists of paying for a certain purchase or transaction on credit and instead of paying it all back at the end of the month interest-free, you pay it off over however many months you decide, including the associated interest or a fixed fee, also reflected in the contract.

To be as transparent as possible with you and to let you know how our 2-day payment card works before you even start the application process, we provide you with an example of the pre-contractual information document (INE) and an example of the contract, which we attach below.

PLEASE NOTE: the NIR and APR numbers that you will see in both the INE example and the sample contract are specific to the EXAMPLE and therefore may not be those that we will apply to your card, as these conditions in the examples are the maximum applicable. We provide the maximum values for these numbers because, as you have not started the contracting process, we have not been able to study your financial situation, so we cannot tell you in advance what financial conditions you will have on your card. For this reason, we prefer to show you the maximum rates.

The maintenance fee for the Visa&Pay and MyCard is €48.

The deferred payment card (revolving card) is also a credit card, although it is different from the others because it only allows for one payment method to pay back the credit used during the month: the deferred payment with an associated interest rate from the time you use the credit until you pay it back in full. Lets you pay back the credit you use by way of a monthly instalment, instead of paying the full amount at the end of the agreed settlement period. You decide what monthly instalment you want to make to pay back the credit used. Even if you spend more credit each month than the chosen instalment, you will only pay the chosen instalment, provided that the amount paid back is the minimum specified by CaixaBank Payments & Consumer to ensure your debt is repaid in a timely manner. When choosing how much you want your monthly instalment to be, bear in mind that the higher it is, the lower the total cost of the credit to be repaid, because you will repay the loaned credit sooner.

With this card, you will not be able to choose to pay the credit used in full at the end of the month, with no interest, like a standard credit card, because it is a deferred payment card. However, there is no limit to the amount of the monthly payment, meaning you can choose a monthly instalment that pays off the full amount of credit used that month, at the end of the month, but paying interest from the time you used the credit until said credit is paid off in full.

The card also offers the split payment option to pay for certain purchases. It does not accrue interest, but it is only intended to finance specific purchases that comprise a commercial unit with the financing offered by the card. Because of this, the split payment offered by this card is reserved for purchases in which CaixaBank expressly offers the instalment payment method. With this option, you will have to return the credit used for the split purchase, divided by the number of months you select for the instalment (example; if you decide to split up a €60 purchase over 3 months, you have to pay back €20 a month for 3 months).

The maintenance fee for the Visa&GO is €36.

To be as transparent as possible with you and to let you know how our deferred payment card works before you even start the application process, we provide you with an example of the pre-contractual information document (INE) and an example of the contract, which we attach below.

PLEASE NOTE: the NIR and APR numbers that you will see in both the INE example and the sample contract are specific to the EXAMPLE and therefore may not be those that we will apply to your card, as these conditions in the examples are the maximum applicable. We provide the maximum values for these numbers because, as you have not started the contracting process, we have not been able to study your financial situation, so we cannot tell you in advance what financial conditions you will have on your card. For this reason, we prefer to show you the maximum rates.

You can obtain more information about cards by accessing these useful links: