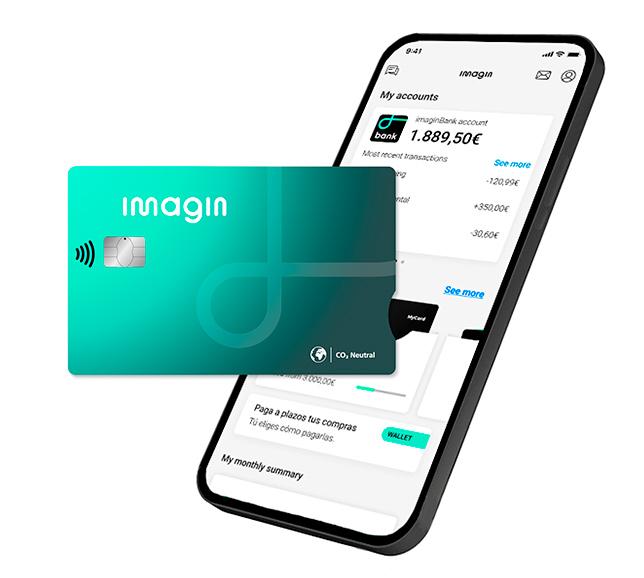

1. No account maintenance fee. The account does not pay interest (0% APR, 0% NIR). CaixaBank, S.A., with Tax ID A08663619, registered in the Special Administrative Register of the Bank of Spain, under code 2100, is the entity offering the bank account.

2. Free of issuance and maintenance fees. CaixaBank, S.A., markets products offered by the hybrid payment institution that offers the debit card, CaixaBank Payments & Consumer, E. F. C., E. P., S. A. U., (hereinafter CPC), with registered office at Avenida de Manoteras n.º 20, Edificio París (28050 Madrid). The system chosen by CPC to protect the funds of payment service users is to deposit them in a separate account opened with CaixaBank, S.A. Issuance of the card subject to approval by the CPC. You can see the usual prices for frequent banking services (Annex 1) at www.caixabank.es/particular/general/tarifascomisiones_es.html.

3. This credit card is issued subject to an analysis of the applicant's credit rating and their capacity to repay, in keeping with the risk policies of CaixaBank Payments & Consumer, E. F. C., E. P., S. A. U. Card issued by the hybrid payment entity CaixaBank Payments & Consumer, E. F. C., E. P., S. A. U. ("CPC"), with tax code A-08980153, registered in the Bank of Spain's Official Register of Companies with code 8776. CaixaBank, S.A. acts as the agent of the card issuing entity. The system chosen by CPC to protect the funds of payment service users is to deposit them in a separate account opened with CaixaBank, S.A.

4. CaixaBank, S.A., with Tax ID A08663619, registered in the Bank of Spain's Special Administrative Register, under number 2100, and the entity offering Bizum payment. To be able to send money using Bizum, both the sender and recipient must be registered for Bizum. The issuer must also have an account open with CaixaBank. If the recipient is not registered, an SMS will be sent to them to register and receive the money.

5. imagin, trademark of imaginersGen, S.A. agent of CaixaBank, S.A. CaixaBank S.A. markets products of the hybrid payment entity that issues the debit cards. CaixaBank Payments & Consumer, EF, AP, AU, (“CPC”), with address at Avinguda de Manoteras no. 20, Paris Building (28050 Madrid). The system for protecting the funds of customers using payment services chosen by CPC is the deposit in a separate account opened at CaixaBank. The card has €0 in issuance and maintenance fees. You can consult the prices usually applied to the most frequently provided banking services (Appendix 1) at www.caixabank.es/tarifas

6. You can consult the conditions of the CaixaBankProtect© service at www.caixabank.es/caixabankprotect.

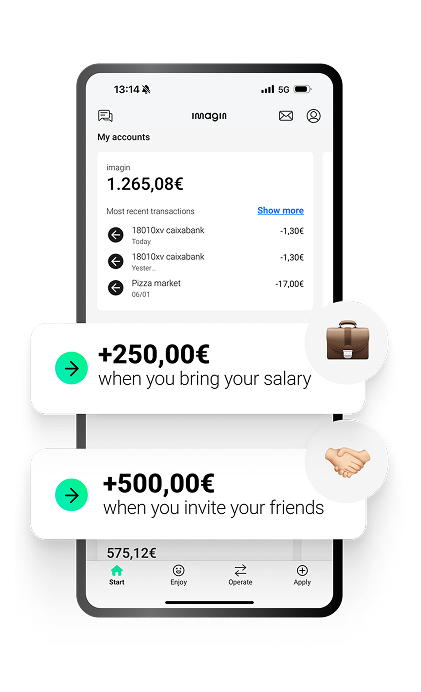

7. You will be deemed to have received a salary when you receive a payment described as such. Transfers are not considered salary payments for the purposes of this campaign.

8. Offer of €150 net valid throughout the national territory for new payroll direct debits from €900 to €1,499.99 in an account opened at imaginBank, with a duration of 48 months. Offer of €250 net valid throughout the national territory for new payroll direct debits of €1,500 or more in an account opened at imaginBank, with a duration of 48 months. In any of these cases, the income is considered monetary remuneration, so it may be affected by current tax regulations in the event that you have to file an income tax return. Not cumulative with other income direct debit promotions (payroll, self-employed or pensions) carried out after 01/01/2022 or with direct debit payrolls that come from another CaixaBank account. More information at www.imagin.com

9. The offer consists of paying you €50 for each person who registers as a new ImaginBank customer using the friend code we will give you. To get the money, the person you invite has to i) open an account, ii) have a minimum of €5 in the account and iii) activate the Bizum service. The maximum we will pay you for this offer is €500 (10 friends). Account offered by Caixabank S.A.

10. TERMS AND CONDITIONS OF SALE: Sale offered by Facilitea Selectplace, S.A.U. ("Facilitea"), Gran Via de les Corts Catalanes, 159, 08014 Barcelona, Tax ID: A-58481730. Sale limited to purchases made in mainland Spain and the Balearic Islands. The products will be delivered within 7 business days from the order date.

11. FINANCING TERMS: Loan financing offered by CaixaBank, S.A. and card financing offered by the hybrid payment institution CaixaBank Payments & Consumer, E.F.C., E.P., S.A.U. ("CPC"). The system chosen by CPC to protect the funds of payment service users is to deposit them in a separate account opened with CaixaBank, S.A. Financing subject to approval. Financing is granted for the full price indicated and exclusively for the purchase of the product from Facilitea.

12. The minimum age for requesting a Youth Card depends on which type of Card you want and the Autonomous Community you live in. In Catalonia, the Balearic Islands and Asturias, you can request a non-financial version from the age of 12, the debit card and prepaid version from the age of 14 and the credit card version from the age of 18. In the Canary Islands and Melilla, you can apply for a non-financial version and the debit and prepaid version from the age of 14, and the credit card version from the age of 18. In Murcia, you can apply for the non-financial version and the debit card version from the age of 14 and the credit card version from the age of 18. In Madrid, Castilla y León and Navarra, you can apply for the debit card version from the age of 14 and the credit card version from the age of 18. Card types: The Youth Card, a non-financial card for young people between 12 and 30 years old in Catalonia, the Balearic Islands and Asturias and between 14 and 30 years old in Melilla, Murcia and the Canary Islands. The Youth Card, a debit card for young people between 14 and 30 years old and a credit card, for people between 18 and 30 years old. Card issued by the hybrid payment institution CaixaBank Payments & Consumer, E.F.C. E.P., S.A.U. ("CPC"), with registered office at Avenida de Manoteras nº 20, Edificio París (28050 Madrid). CaixaBank, S.A. acts as the agent of the card issuing entity. Card issuance subject to approval by CPC. You can view the prices usually applied to the banking services most frequently provided (Annex 1) at: www.caixabank.es/tarifas. Youth Card, prepaid card for young people from 14 to 30 years of age. Prepaid card issued by the electronic money institution Global Payments MoneyToPay, EDE, S.L. ("M2P"), with registered office at Avenida de Manoteras n.º 20, Edificio París (28050 Madrid). CaixaBank, S.A. acts as the agent of the cards issuing entity. The system chosen by CPC and M2P to protect the funds of payment service users is to deposit them in a separate account opened with CaixaBank, S.A. For all types of Cards mentioned: CPC includes free travel assistance insurance. Advertising by imaginerGen, S.A., owner of the "imagin" trademark, which promotes and publicises the Carné Joven programme. imaginersGen S.A. is an agent of CaixaBank S.A., which has Tax ID no. A-08663619 and is listed in the Bank of Spain Official Register of Companies under number 2100.

13. CaixaBank will not charge you for withdrawing cash by debit from the MyCard or credit card from whichever cash is received.

ImaginBank by CaixaBank. Imagin, the trading name of imaginersGen, SA, is an agent of CaixaBank, S.A., the bank offering the financial services.

NRI: 6962-2024/09542